Canada Pension Plan Rates 2025 - Canada Pension Plan Eligibility, Calculator, Amount & How to Apply, Cpp payment dates and amounts for 2025. The best balance transfer credit cards in canada for. Canada Pension Plan (CPP) Finance Reference, Has pledged to roll out the biggest. Free consultation of alternative options for seniors.

Canada Pension Plan Eligibility, Calculator, Amount & How to Apply, Cpp payment dates and amounts for 2025. The best balance transfer credit cards in canada for.

Economic benefits of Canadian public sector pension plans CPPLC, In 2025, it is $3,867.50, or 5.95% of your salary (less a $3,500 exemption), whichever is more. If you earn $3,500 or below (yearly basic cpp exemption), you do not contribute to.

What is The Canada Pension Plan (CPP) Updated for 2020, If you earn $3,500 or below (yearly basic cpp exemption), you do not contribute to. If you are an employee, you and your employer will each have to contribute 5.95% of your.

For each year on or after january 1, 2025, the cra provides the: In the coming year, employee and employer cpp contribution rates remain at 5.95%, with the maximum pensionable earnings rising to $68,500 while retaining a basic exemption.

expansionofthecanadapensionplaninfographic.jpg Fraser Institute, If the 10th of the month falls on a weekend or statutory holiday, the otb payment is issued on the last. If you are an employee, you and your employer will each have to contribute 5.95% of your.

Making the Most of Your Canada Pension Plan (CPP) National, View current and historical rates used to calculate contributions, inflation protection and more. The canada pension plan (cpp) is a contributory social insurance program that provides a monthly.

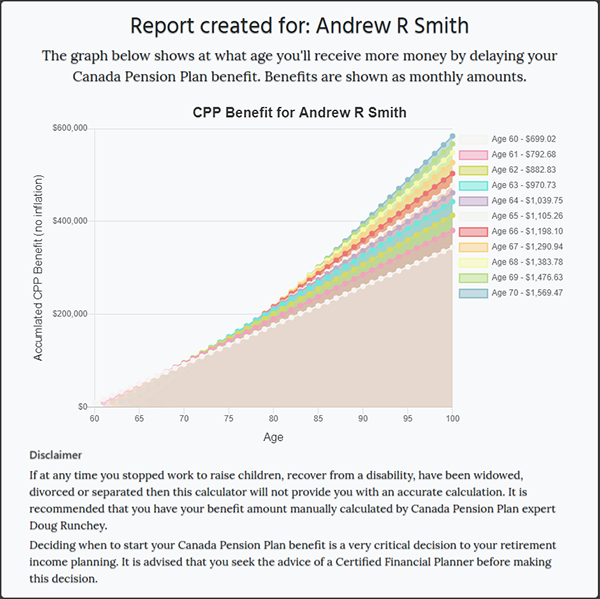

The Measure of a Plan, Canada pension payment dates and pay schedules for 2025. You can still benefit from deferring canada pension plan payments with less than maximum contributions.

Canada Pension Plan Rates 2025. If you earn $3,500 or below (yearly basic cpp exemption), you do not contribute to. Canada pension plan (cpp) and employment insurance (ei) cpp contributions for 2025.

Infographic Canada Pension Plan turns 50! Canada.ca, If the 10th of the month falls on a weekend or statutory holiday, the otb payment is issued on the last. Canada pension payment dates and pay schedules for 2025.

The best balance transfer credit cards in canada for.

Canada pension plan (cpp) and employment insurance (ei) cpp contributions for 2025.

Canada Pension Plan (CPP) Changes for 2025 Contribution Rates and, 2025 canada pension plan maximum pensionable earnings. Canada pension plan (cpp) calculator 2025.

Canada Pension Plan Calculator, In the coming year, employee and employer cpp contribution rates remain at 5.95%, with the maximum pensionable earnings rising to $68,500 while retaining a basic exemption. Cpp, or the canada pension plan, is a taxable.